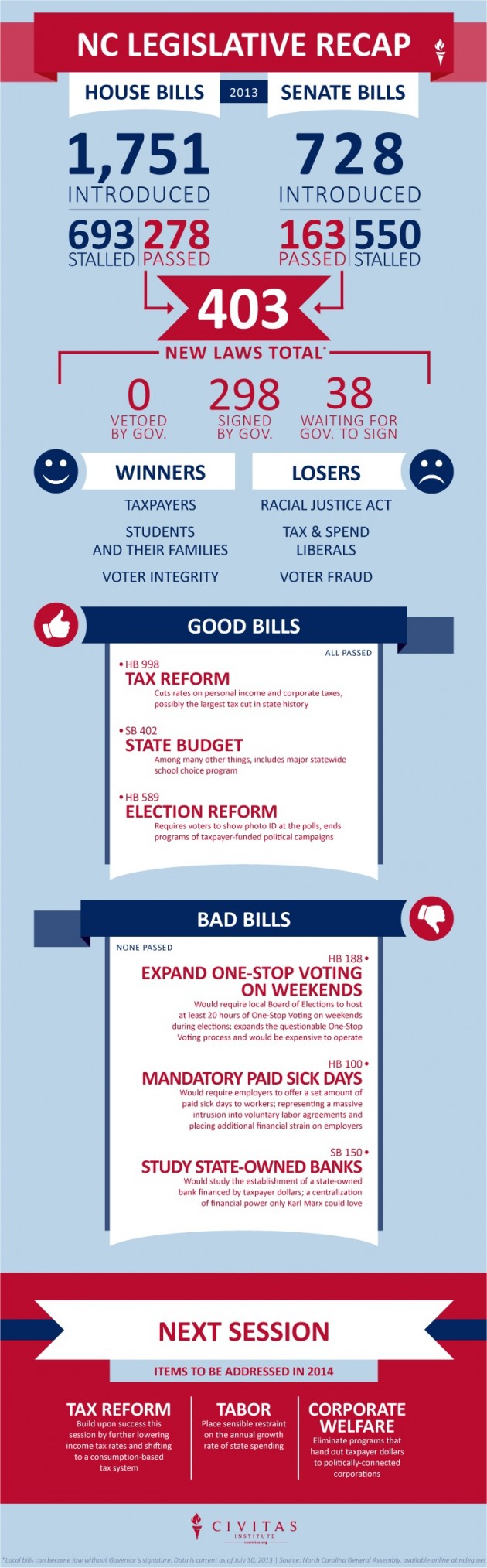

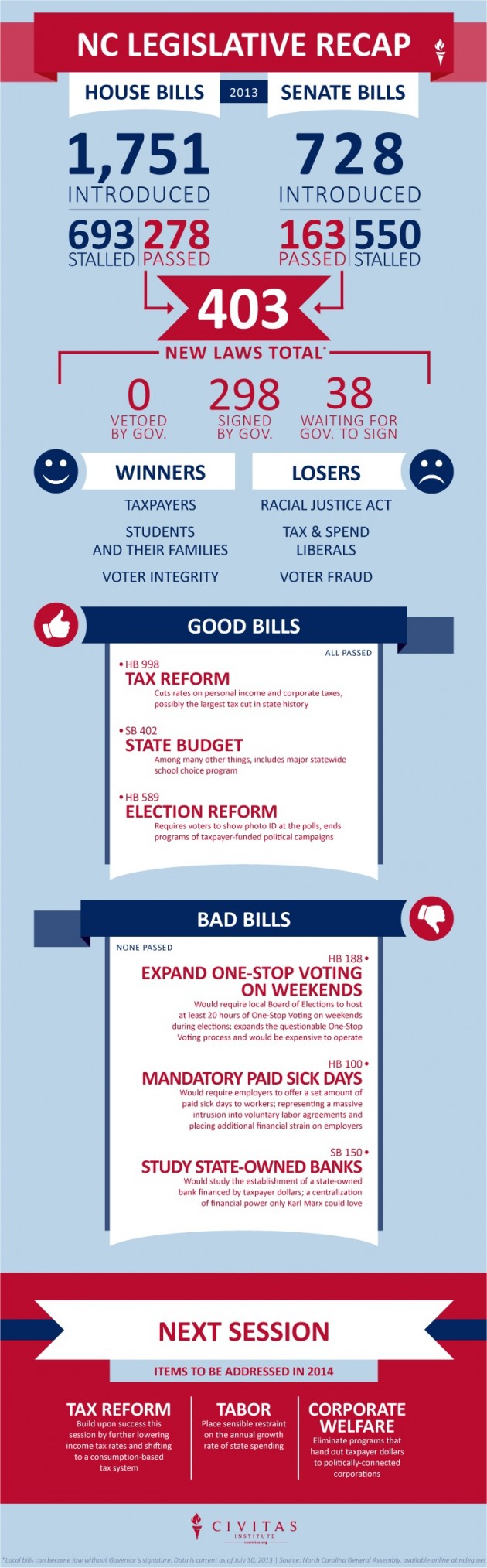

Publisher's note: This post, by Civitas Staff, was originally published in the Budget & Taxes, Education, Issues, Legislative Activity section(s) of Civitas's online edition.

As the dust settles on the landmark 2013 North Carolina legislative session, conservatives can look upon the accomplishments of the state legislature and find much to celebrate. A catalog of policies that conservatives have for years been advocating for finally became reality. The number of reforms and improvements implemented in just one session may be unprecedented for any state government in the modern era. Even consistently "red" states typically take years to accomplish what North Carolina did in the span of six months.

With Republican majorities in both legislative chambers combined with a Republican Governor for the first time in roughly 150 years, the time was right to begin unraveling generations of big-government, liberal policies that had become the norm in the Tar Heel State.

Conservative policies spanning taxation, education, health care, elections and criminal justice were passed this year, much to the chagrin of liberal elites that now see their stranglehold on power slipping away. While left-wing extremist protesters and liberal media outlets like the New York Times and MSNBC cry out that North Carolina moved "backwards," it is indeed those liberals who wanted to preserve the failed policies of the past.

Following is a list of policy victories in 2013 that conservatives in North Carolina should be proud of.

Tax Reform

North Carolina took a major step toward making itself more economically competitive by reforming its tax code. Personal and corporate income tax rates were significantly reduced, several sales tax loopholes were closed and the state's economy will benefit from what is projected to be a net tax cut of $2.4 billion over the next five years compared to the old tax code.

The Tax Foundation stated the reform would vault North Carolina from the 7th worst business tax climate in the nation to the 17th best. Highlights of the tax reform plan include:

• Personal income tax rate is reduced from a progressive rate topping out at 7.75 percent to a flat rate of 5.75 percent by 2015

• A larger standard deduction of $7,500 of income for singles and $15,000 for married filers is created

• The $50,000 income deduction for small businesses is eliminated in 2014

• Social Security income will still be fully exempt

• Taxpayers will still be allowed to take the greater of the standard deduction or itemized deductions, with itemized deductions limited to unlimited charitable contributions plus mortgage interest deductions and property taxes capped at $20,000

• Repeals the state estate tax (aka the death tax)

• Reduces corporate income tax rate to 5 percent from the current 6.9 percent by 2015

• If certain revenue targets are met, the corporate rate would decrease to 4 percent in 2016 and 3 percent in 2015

• State sales tax rate of 4.75 percent and local rate of 2 percent remain unchanged; keeping combined rate at 6.75 percent for most counties

• Adds service contracts on tangible goods to the sales tax base, along with most attractions (like movies, fairs) for which admission is charged to the sales tax base

• Places a cap of $45 million on the sales tax refund nonprofit entities (including most large hospitals) can claim. This cap would not impact any nonprofit organizations at the current time

State Budget

The FY 2013-14 state budget spends a total of $20.6 billion for this fiscal year, up about 2.5 percent from last year's $20.18 billion budget, and marks a 39 percent increase in the state budget over 10 years. The 2.5 percent increase can almost entirely be attributed to Medicaid cost overruns and projected Medicaid cost increases beyond the legislature's control. Without the additional Medicaid expenses, year-over-year spending could very well have remained flat or even experienced a slight decline.

Highlights from the state budget include:

• Total state spending on public (K-12) education comes to $7.9 billion - up nearly $400 million over last year's appropriation

• Implementation of opportunity scholarships in the second year of the biennium, providing vouchers of up to $4,200 for low-income families to use toward private school tuition.

• A provision allowing for the state's executive branch to develop a reform plan for the state's Medicaid program

• $12.4 million in lottery money to fund an additional 2,500 slots in the NC Pre-K (formerly More at Four) program

• An additional $434 million to pay for increasing Medicaid costs. This is in addition to the $308 million already set aside in the current budget year to cover Medicaid cost overruns

• Capping of the state gas tax at 37.5 cents per gallon until July 30, 2015, estimated to save motorists $2.4 million this year

• No pay raise for state employees, but the addition of five more paid days off

• $1 million for the implementation of the Voter Information and Verification Act (voter ID)

• Creation of a fund to compensate verified victims of the state's former eugenics program at a cost of $10 million

Education

The just-completed legislative session produced a number of significant education victories for conservatives. Lawmakers enacted major legislation to reform public schools and also to expand educational opportunity. Some of the major highlights include:

•

Budget: Provides $7.86 billion to run North Carolina public schools. The 2013-14 education appropriations represent an increase of $361 million over the previous year. Money for K-12 public schools represents about 38 percent of the state budget.

•

Tenure Reform: Eliminates "career" status for teachers. Allows school districts to offer teachers contracts of one to four years in length based on years of experience. School districts will have the option to renew the contracts based on performance measures.

•

Opportunity Scholarship Act: Sets aside $10 million in 2014-15 for vouchers of up to $4,200 to families who qualify for federal free and reduced cost lunch program. Recipients must be currently enrolled in a public school and can use the money for tuition or other educational expenses at a private school.

•

Special Needs Vouchers: Provides grants of $3,000 per semester and $6,000 annually for parents of special needs children to attend private school. Legislature appropriates $3 million for vouchers in 2013-14.

•

Common Core: Requires State Board of Education to get legislative approval before purchasing or implementing a new assessment instrument to assess student achievement on Common Core Standards.

•

School Report Cards: Requires State Board of Education to issue school achievement, growth and performance grades to North Carolina public schools.

Medicaid Reform

The 2013-14 state budget includes a provision enabling the governor's office to craft a plan to reform the state's Medicaid program. Titled "The Partnership for a Healthy North Carolina," McCrory's plan would alter the current Medicaid system into a more patient-centered, fiscally responsible program.

Rather than a one-size-fits all program that reimburses providers at one specific set rate for each specific procedure they perform for patients, the Partnership would allow patients to pick from a variety of coverage plans that best suit their needs. Insurance companies would compete to be included in the program, and would be reimbursed by the Medicaid program on a per enrollee basis, thus assuming the risk and incentive to control costs.

Election Reform

It took nearly three months for the State Senate to take up the Voter Photo ID bill the House passed in April, but it was worth the wait. House Bill 589, the Voter Information Verification Act (VIVA), will begin to bring North Carolina's election process into the 21st century.

The State Senate took a weak and confusing attempt at voter photo identification and made it into a photo ID requirement that is strong enough to begin to restore confidence in our electoral system.

But the Senate didn't stop with voter photo ID, they also eliminated Same-Day Registration so that everyone will be required to register at least 25 days before Election Day. This will give the local boards more time to verify a registrant's address, thus detect fraud. Also, the early voting period was shortened from 17 days to 10. This change will standardize early voting and make the voting sites and times uniform among counties.

The landmark legislation also eliminates straight party voting, an antiquated practice that was made even worse when the Democrats in the 1970′s worried that North Carolinians who had a penchant for voting for Republican Presidential candidates would begin to push the straight-party lever so they removed the presidential race from the straight-party vote.

No longer will 16 & 17 year olds be allowed to register to vote. This law was promoted by liberal organizations who pushed this legislation through the legislature in 2009 in order to obtain personal information of teenagers that they couldn't get anywhere else. VIVA also discontinues the practice of paid voter registration drives and the practice of voting out of precinct on Election Day using a provisional ballot.

The bill also includes the first change in contribution limits in more than 10 years. The campaign contribution limit will be increased from $4,000 per election to $5,000. The inflation adjustment will aid candidates who don't fund their campaigns with their own money.

There are several other provisions in North Carolina's new election reform law, including:

• Prohibition of online voter registration

• Elimination of taxpayer-financed campaigns (see section below)

• Limitations on who can assist a voter adjudicated to be incompetent by court

• Moving the presidential primary to the first Tuesday after South Carolina's

• Requiring all voting systems to produce a paper ballot

• Changing the order of candidates on a General Election ballot. Now the party whose nominee for Governor received the most votes in the most recent gubernatorial election will have their candidates listed first

• VIVA is the first comprehensive updating of our election laws in several decades. North Carolina's election system has become a jumble of complex and sometimes contradictory laws and administrative decisions. The process is confusing and dysfunctional, with no built-in security to protect the integrity of a person's vote. This bill will start to restore sanity to the election and voting process.

Fiscal Restraint and Transparency

Fiscal Restraint and Transparency

Legislation was passed placing restrictions on state debt that can be incurred without voter approval. "Special indebtedness," in particular Certificates of Participation, have been utilized exclusively in North Carolina since 2000. Such debt does not require voter approval. Due to this trend, a significant portion of outstanding state debt was never subject to a vote of citizens. The new legislation places a cap on the percentage of state debt that can be special indebtedness. Given the parameters of this new law, any new state debt legislators wish to issue will be required to first garner voter approval for several years to come. As the amount of special indebtedness as a share of total state debt shrinks, however, there will be opportunities in the future to once again issue COPs and other forms of debt not requiring voter approval.

Other debt-related legislation will increase the transparency of local debt. HB 248 will inform local voters about the interest being charged on local bond referendums. The new law requires an estimate of the total amount of interest payments that will be required on the debt in the bond order published by the local government clerk. It will also mandate language on the bond ballot itself informing voters that not only the principal but also interest will be required to pay down the debt they are voting for, and that new taxes may be required to pay down the additional debt. Previously, voters have only been informed about the principal amount of the debt. This legislation is a major step toward increasing transparency about the true cost of government debt.

Elimination of Taxpayer-Funded Campaigns

In 2004 North Carolina instituted a program by which candidates for the state Supreme Court and Court of Appeals positions could use taxpayer dollars to fund their campaigns. A similar program for Council of State races was created in 2008. In essence, taxpayer dollars paid in to the state's General Fund were made available for political candidates to fund their campaigns, forcing taxpayers to finance political speech they may well abhor.

A section of the Voter ID bill eliminates these programs.