Publisher's note: Agenda 2012 is the John Locke Foundation's charge to make known their wise political agenda to voters, and most especially candidates, with our second installment being the "State Tax Burden," written by Fergus Hodgson, Director of Fiscal Policy Studies,

John Locke Foundation. The first installment was the "Introduction" published here.

Taxation is the taking of property and earnings in exchange for governmentally provided goods and services or for redistribution. Legislators may also structure taxes as a policy tool to manipulate constituent actions for or against particular goods or services. North Carolina state officials, for example, offer tax breaks for companies they deem particularly desirable while placing sin taxes on an array of items such as alcohol, candy, and tobacco.

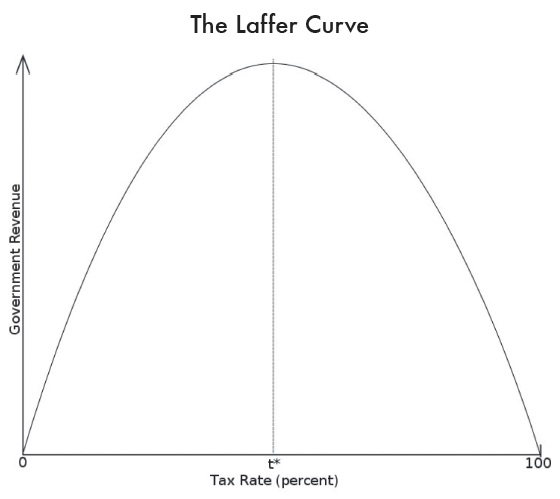

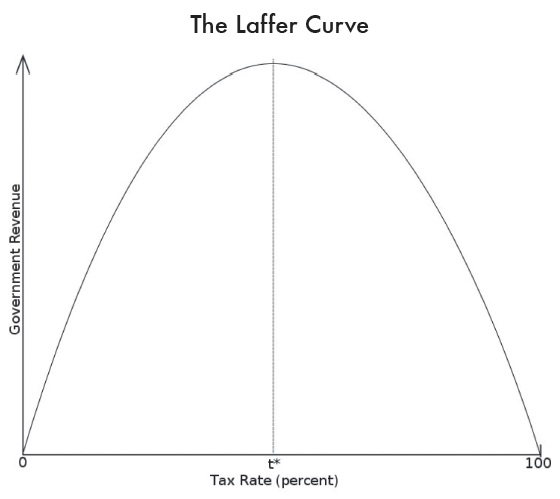

The mandatory element of taxation means that to avoid paying, aside from breaking the law, one must either transfer assets or residency to another jurisdiction or choose not to generate the wealth in the first place. These two legal responses lead to an important tax policy trade-off known as the Laffer Curve (pictured below).

Art Laffer popularized the economic reality that at some point higher tax rates lower the total revenue generated. That is because higher rates, particularly high marginal rates on high earners, discourage participation in the labor force and net inwards migration. They also dissuade investment in the taxing jurisdiction relative to consumption or investment elsewhere.

In addition to a tax burden's negative incentives, when legislators apply the burden in a discriminatory manner, they distort economic decisions and allocate resources away from where they would bring the greatest prosperity.

So jurisdictions such as the state of North Carolina are in a competitive taxation market. To serve constituents best, cause as little damage on economic opportunity as possible, and generate the revenue necessary for legitimate government activities, legislators would be best to keep rates low and spread in a simple, even manner.

Key Facts

• The Tax Foundation ranks North Carolina's business tax climate as 44th in the nation and by far the worst in the South. The states with the lowest tax burdens do without at least one of the five taxes measured -- corporate, personal income, retail sales, unemployment insurance, and property. North Carolina imposes all of these taxes and many more. The same study gives poor rankings to North Carolina's personal income tax (43rd), corporate income tax (29th), and retail sales taxes (47th).

• The majority of the state's General Fund revenues, 77 percent, come from personal income and sales taxes -- 50 and 27 percent respectively. These two taxes produce $15 billion in total revenue. By comparison, North Carolina's corporate income tax generates 4 percent of General Fund revenues, or $900 million.

• High personal and corporate income taxes hurt North Carolina's international competitiveness. If you include federal and state tax rates on dividends, capital gains, and corporate income, North Carolina's top marginal rate on corporate investment is 53 percent, the 4th highest in the industrialized world.

• North Carolina's highest personal income tax rate, 7.75 percent on all income over $60,000, is the highest in the South and the 11th highest in the nation.

Recommendations

1.

Eliminate the corporate income tax, which, along with being onerously high, promotes lobbying for exemptions. These distort investment allocation, further complicate the code, and undermine the goal of funding government, since the tax generates a tiny percentage of total state revenues.

2.

Avoid all targeted tax exemptions or penalties. These undermine individual freedom, distort investment allocation, complicate the tax code, and feed wasteful lobbying.

3.

Enact a Taxpayer Bill of Rights as an amendment to the state constitution. A North Carolina TABOR should cap annual spending growth at the combined growth of inflation and population, and require a supermajority in the legislature to raise state taxes.

4.

Eliminate the estate tax. Along with the corporate income tax, research has shown the estate tax to have a disproportionately large impact on investment and economic growth. Given that it is projected to raise only $92 million in 2013, or less than half of one percent of General Fund revenue, state government can clearly do without this extra layer of taxation.

Analyst: Fergus Hodgson

Director of Fiscal Policy Studies

(919)828-3876 •

fhodgson@johnlocke.org