The Human Touch Revealing All that is Real

Did You Know? Majority of Federal Funding for College Is for Student Loans

Publisher's note: The James G. Martin Center for Academic Renewal is a nonprofit institute dedicated to improving higher education in North Carolina and the nation. Located in Raleigh, North Carolina, it has been an independent 501(c)(3) organization since 2003. It was known as the John W. Pope Center for Higher Education Policy until early January 2017.

The author of this post is Anthony Hennen.

The federal government has grown in importance for higher education for decades. The most long-lasting effect could be its status as the lender of first resort for student loans. The vast majority of federal spending on colleges and universities comes in the form of making loans, dwarfing all other activities.

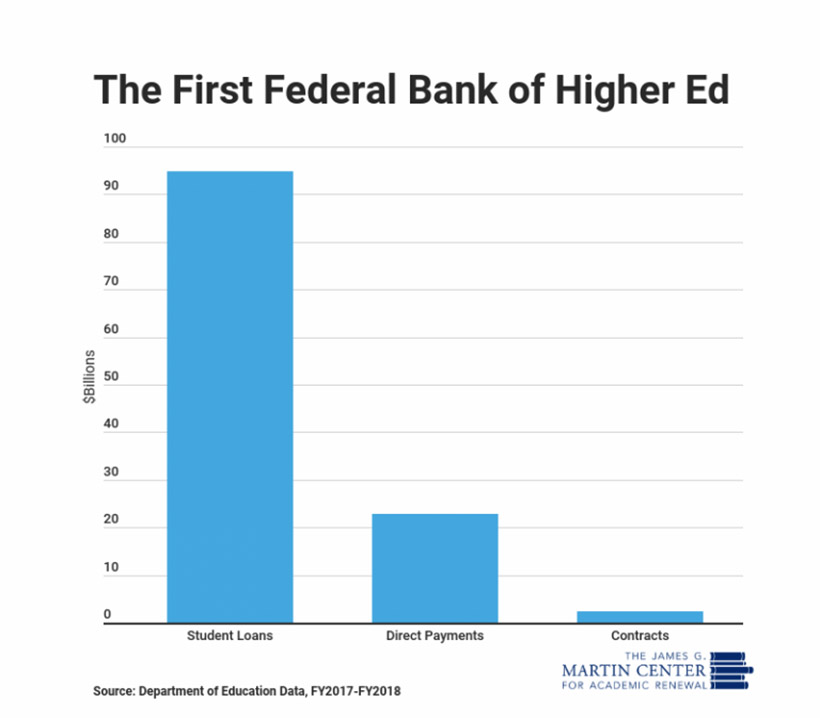

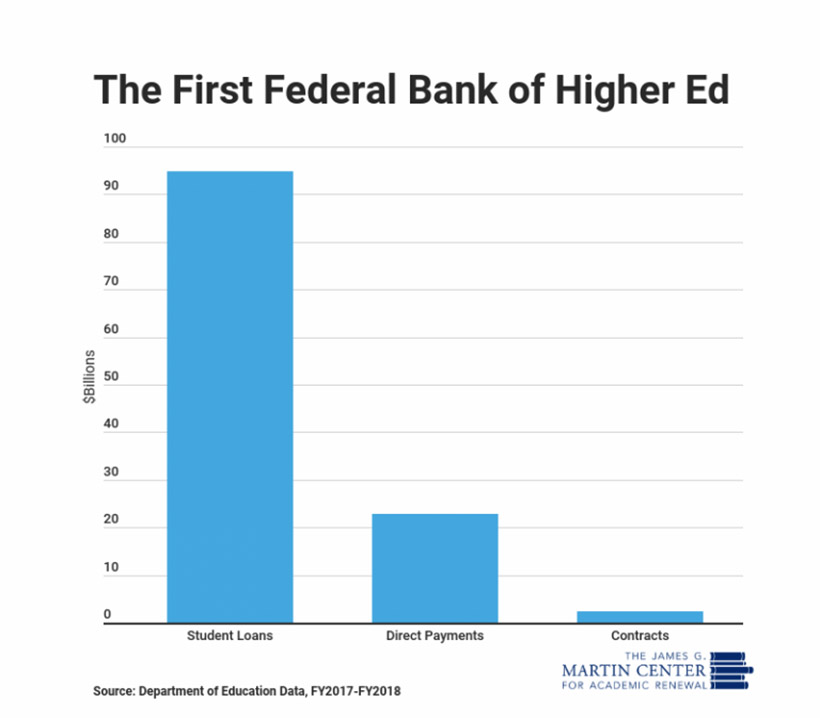

Of the $120 billion supplied by the Department of Education for higher ed institutions in FY2017-FY2018, 79 percent of this support (about $95 billion) was in the form of student loans, according to Open the Books, a nonprofit government watchdog.

Another 19 percent of funding was for direct payments, such as grants, and contracts made up 2 percent of federal funding. The vast majority, about 91 percent, of that funding went to traditional schools and community colleges. However, for-profit colleges and cosmetology schools received the rest, roughly $11 billion.

In theory, those loans wouldn't be a problem because the students would graduate and then repay their loans accordingly. In reality, however, borrowers often don't graduate, struggle to repay their loans, fall behind on their payments, and default. Borrowers can avoid default by enrolling in income-driven repayment (IDR) plans, but as these plans grow in popularity, graduate students with higher debt have flocked to them. IDR plans end in de facto loan forgiveness, and the Congressional Budget Office projects that $167 billion in graduate student debt and $40 billion in undergraduate student debt will be forgiven by 2029.

While loans were seen as a way to help low-income students achieve a college degree, it's become a program that has turned the Education Department into a bank with bad borrowers, leaving taxpayers to cover the bill.

Anthony Hennen in managing editor at the James G. Martin Center for Academic Renewal.

Go Back

The author of this post is Anthony Hennen.

The federal government has grown in importance for higher education for decades. The most long-lasting effect could be its status as the lender of first resort for student loans. The vast majority of federal spending on colleges and universities comes in the form of making loans, dwarfing all other activities.

Of the $120 billion supplied by the Department of Education for higher ed institutions in FY2017-FY2018, 79 percent of this support (about $95 billion) was in the form of student loans, according to Open the Books, a nonprofit government watchdog.

Another 19 percent of funding was for direct payments, such as grants, and contracts made up 2 percent of federal funding. The vast majority, about 91 percent, of that funding went to traditional schools and community colleges. However, for-profit colleges and cosmetology schools received the rest, roughly $11 billion.

In theory, those loans wouldn't be a problem because the students would graduate and then repay their loans accordingly. In reality, however, borrowers often don't graduate, struggle to repay their loans, fall behind on their payments, and default. Borrowers can avoid default by enrolling in income-driven repayment (IDR) plans, but as these plans grow in popularity, graduate students with higher debt have flocked to them. IDR plans end in de facto loan forgiveness, and the Congressional Budget Office projects that $167 billion in graduate student debt and $40 billion in undergraduate student debt will be forgiven by 2029.

While loans were seen as a way to help low-income students achieve a college degree, it's become a program that has turned the Education Department into a bank with bad borrowers, leaving taxpayers to cover the bill.

Anthony Hennen in managing editor at the James G. Martin Center for Academic Renewal.

Comment

Latest Op-Ed & Politics

|

this at the time that pro-Hamas radicals are rioting around the country

Published: Thursday, April 25th, 2024 @ 8:01 am

By: John Steed

|

|

Pro death roundtable

Published: Wednesday, April 24th, 2024 @ 12:39 pm

By: Countrygirl1411

|

|

populist / nationalist anti-immigration AfD most popular party among young voters, CDU second

Published: Wednesday, April 24th, 2024 @ 11:25 am

By: John Steed

|

|

political scheme behhind raid on Mar-a-Lago

Published: Wednesday, April 24th, 2024 @ 9:16 am

By: John Steed

|

|

how many of these will come to North Carolina?

Published: Tuesday, April 23rd, 2024 @ 1:32 pm

By: John Steed

|

|

Barr had previously said he would jump off a bridge before supporting Trump

Published: Tuesday, April 23rd, 2024 @ 11:37 am

By: John Steed

|

|

Babis is leader of opposition in Czech parliament

Published: Tuesday, April 23rd, 2024 @ 10:28 am

By: John Steed

|

|

illegal alien "asylum seeker" migrants are a crime wave on both sides of the Atlantic

Published: Tuesday, April 23rd, 2024 @ 9:44 am

By: John Steed

|

|

only one holdout against acquital

Published: Tuesday, April 23rd, 2024 @ 9:01 am

By: John Steed

|

|

DEI now includes criminals?

Published: Monday, April 22nd, 2024 @ 8:33 pm

By: John Steed

|

|

Biden regime intends to force public school compliance as well as colleges

Published: Monday, April 22nd, 2024 @ 1:55 pm

By: John Steed

|

|

clamps down on oil drilling in Alaska

Published: Monday, April 22nd, 2024 @ 9:09 am

By: John Steed

|

|

plan put in place by Eric Holder

Published: Monday, April 22nd, 2024 @ 7:38 am

By: John Steed

|

|

prosecutors appeal acquittal of member of parliament in lower court for posting Bible verse

Published: Sunday, April 21st, 2024 @ 9:14 am

By: John Steed

|

|

Biden abuses power to turn statute on its head; womens groups to sue

Published: Friday, April 19th, 2024 @ 8:28 pm

By: John Steed

|

|

The Missouri Senate approved a constitutional amendment to ban non-U.S. citizens from voting and also ban ranked-choice voting.

Published: Friday, April 19th, 2024 @ 12:33 pm

By: Daily Wire

|

The biggest expense in education is the mismanagement by a bloated administration through their bad management of spending, and student's expectations, and hugely, overpaid professors, who live one charmed life.