Our Community Platform providing Essential Information to Know what is Real

Did You Know? UNC System Grads Carry Less Student Debt

Publisher's note: The James G. Martin Center for Academic Renewal is a nonprofit institute dedicated to improving higher education in North Carolina and the nation. Located in Raleigh, North Carolina, it has been an independent 501(c)(3) organization since 2003. It was known as the John W. Pope Center for Higher Education Policy until early January 2017.

The author of this post is David Waugh.

Most students rely on loans to pay for college; colleges raise their prices, and student debt increases. Now, about 44 million students collectively owe $1.6 trillion in student debt.

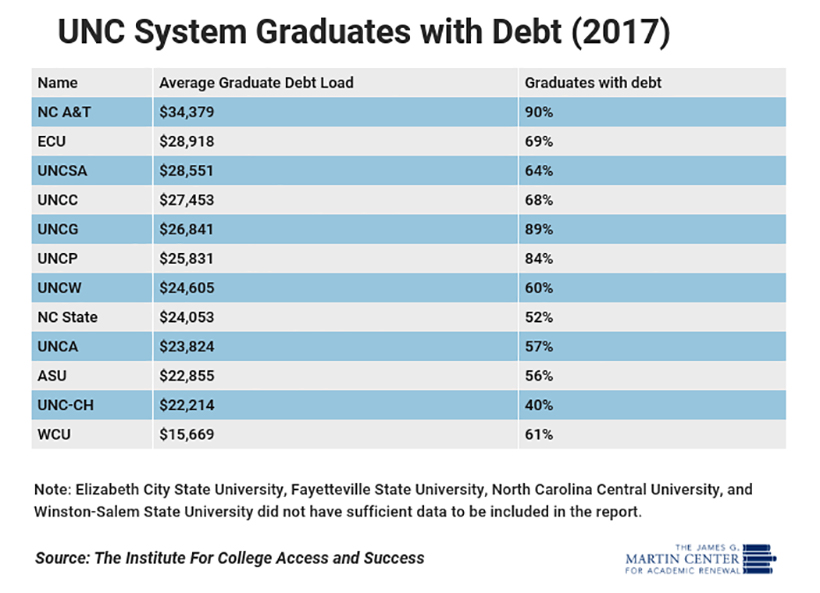

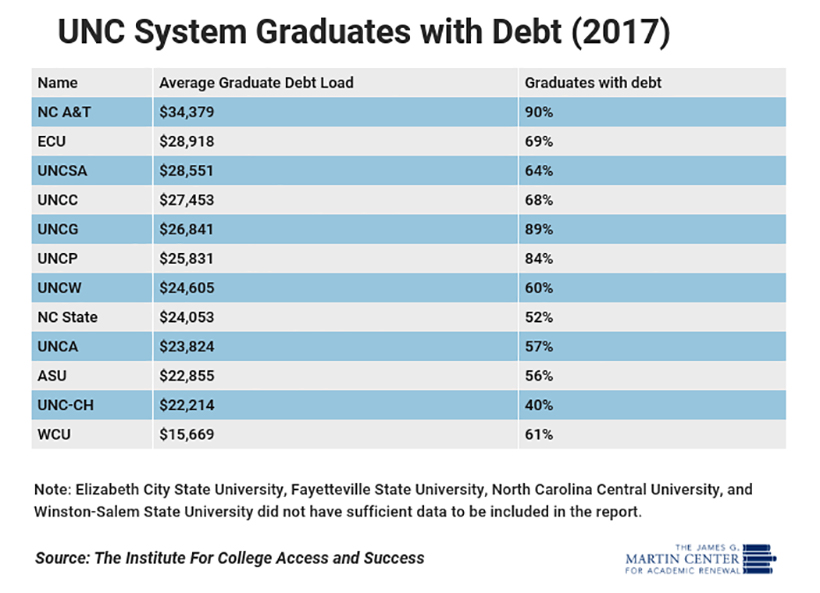

In North Carolina, at least, graduates carry less debt than their peers. North Carolina ranks 37th in the country for total debt levels of its graduates, with the average student holding $26,526 in debt upon graduation.

And the average graduate from a University of North Carolina school holds $25,433 in student debt, less than the state average.

North Carolina's flagship institution, UNC-Chapel Hill, is best at keeping debt proportions low-only 40 percent of its graduates have some form of debt. But at other UNC schools, the picture changes. Most UNC graduates carry some debt, and over 80 percent of graduates from NC A&T, UNC-Greensboro, and UNC-Pembroke leave with debt.

Western Carolina University students hold the least amount of debt per student in the UNC system, with the average student holding $15,669 in debt. This may be in part due to the new NC promise tuition plan, which offers a flat tuition rate of $500 per semester at Western Carolina, Elizabeth City State University, and UNC-Pembroke. The NC Promise plan is funded by $51 million from the state legislature and has resulted in enrollment increases of 14 percent at UNC-P, 6 percent at WCU, and 19 percent at ECSU.

Students are not entirely to blame for taking on so much debt; only wealthy students can afford to pay tuition and fees without loans. The federal government perpetuates this problem by offering easy loans, along with colleges who load students with debt for degrees that don't provide them with the skills necessary to repay the loans. Parents are also complicit for not teaching their children to think about how much debt is too much.

The current political solutions to address this debt problem are not sufficient. So far, they have ignored how colleges and the government make student debt worse and tend to be "quick fixes," such as wealth redistribution. Politicians on the left promote proposals to force the federal government to pay for existing student debt by taxing individual and institutional savings, and politicians on the right ignore the issue entirely.

David Waugh was a Martin Center intern. He studies economics at Hampden-Sydney College.

Go Back

The author of this post is David Waugh.

Most students rely on loans to pay for college; colleges raise their prices, and student debt increases. Now, about 44 million students collectively owe $1.6 trillion in student debt.

In North Carolina, at least, graduates carry less debt than their peers. North Carolina ranks 37th in the country for total debt levels of its graduates, with the average student holding $26,526 in debt upon graduation.

And the average graduate from a University of North Carolina school holds $25,433 in student debt, less than the state average.

North Carolina's flagship institution, UNC-Chapel Hill, is best at keeping debt proportions low-only 40 percent of its graduates have some form of debt. But at other UNC schools, the picture changes. Most UNC graduates carry some debt, and over 80 percent of graduates from NC A&T, UNC-Greensboro, and UNC-Pembroke leave with debt.

Western Carolina University students hold the least amount of debt per student in the UNC system, with the average student holding $15,669 in debt. This may be in part due to the new NC promise tuition plan, which offers a flat tuition rate of $500 per semester at Western Carolina, Elizabeth City State University, and UNC-Pembroke. The NC Promise plan is funded by $51 million from the state legislature and has resulted in enrollment increases of 14 percent at UNC-P, 6 percent at WCU, and 19 percent at ECSU.

Students are not entirely to blame for taking on so much debt; only wealthy students can afford to pay tuition and fees without loans. The federal government perpetuates this problem by offering easy loans, along with colleges who load students with debt for degrees that don't provide them with the skills necessary to repay the loans. Parents are also complicit for not teaching their children to think about how much debt is too much.

The current political solutions to address this debt problem are not sufficient. So far, they have ignored how colleges and the government make student debt worse and tend to be "quick fixes," such as wealth redistribution. Politicians on the left promote proposals to force the federal government to pay for existing student debt by taxing individual and institutional savings, and politicians on the right ignore the issue entirely.

David Waugh was a Martin Center intern. He studies economics at Hampden-Sydney College.

| The Stately Pillars of the Fourth Estate Must Remain Strong | James G. Martin Center for Academic Renewal, Editorials, Op-Ed & Politics | Gov. Cooper Announces Boards and Commissions Appointments |

Latest Op-Ed & Politics

|

this at the time that pro-Hamas radicals are rioting around the country

Published: Thursday, April 25th, 2024 @ 8:01 am

By: John Steed

|

|

Pro death roundtable

Published: Wednesday, April 24th, 2024 @ 12:39 pm

By: Countrygirl1411

|

|

populist / nationalist anti-immigration AfD most popular party among young voters, CDU second

Published: Wednesday, April 24th, 2024 @ 11:25 am

By: John Steed

|

|

political scheme behhind raid on Mar-a-Lago

Published: Wednesday, April 24th, 2024 @ 9:16 am

By: John Steed

|

|

how many of these will come to North Carolina?

Published: Tuesday, April 23rd, 2024 @ 1:32 pm

By: John Steed

|

|

Barr had previously said he would jump off a bridge before supporting Trump

Published: Tuesday, April 23rd, 2024 @ 11:37 am

By: John Steed

|

|

Babis is leader of opposition in Czech parliament

Published: Tuesday, April 23rd, 2024 @ 10:28 am

By: John Steed

|

|

illegal alien "asylum seeker" migrants are a crime wave on both sides of the Atlantic

Published: Tuesday, April 23rd, 2024 @ 9:44 am

By: John Steed

|

|

only one holdout against acquital

Published: Tuesday, April 23rd, 2024 @ 9:01 am

By: John Steed

|

|

DEI now includes criminals?

Published: Monday, April 22nd, 2024 @ 8:33 pm

By: John Steed

|

|

Biden regime intends to force public school compliance as well as colleges

Published: Monday, April 22nd, 2024 @ 1:55 pm

By: John Steed

|

|

clamps down on oil drilling in Alaska

Published: Monday, April 22nd, 2024 @ 9:09 am

By: John Steed

|

|

plan put in place by Eric Holder

Published: Monday, April 22nd, 2024 @ 7:38 am

By: John Steed

|

|

prosecutors appeal acquittal of member of parliament in lower court for posting Bible verse

Published: Sunday, April 21st, 2024 @ 9:14 am

By: John Steed

|

|

Biden abuses power to turn statute on its head; womens groups to sue

Published: Friday, April 19th, 2024 @ 8:28 pm

By: John Steed

|

|

The Missouri Senate approved a constitutional amendment to ban non-U.S. citizens from voting and also ban ranked-choice voting.

Published: Friday, April 19th, 2024 @ 12:33 pm

By: Daily Wire

|