Folwell: State Pension Fund Lost Money Last Year | Eastern North Carolina Now

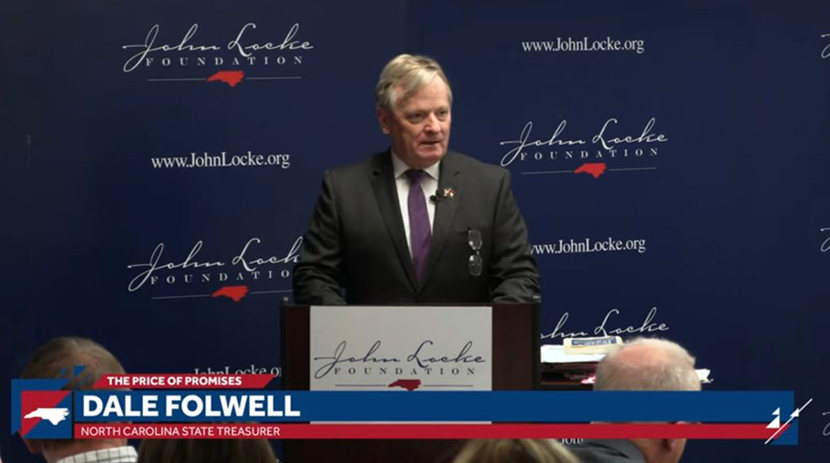

State Treasurer Dale Folwell says the state pension plan hemorrhaged $4.1 billion in 2018

| Tillis & Van Hollen Introduce Bipartisan Legislation to Encourage IPOs | Carolina Journal, Editorials, Op-Ed & Politics | Senator Thom Tillis Stands with the Democrats |

|

Vice President Kamala Harris’ husband, Doug Emhoff, admitted that he cheated on his first wife with the couple’s babysitter after a report was published on Saturday that said the marriage ended after he got the babysitter pregnant.

Published: Wednesday, August 14th, 2024 @ 11:11 am

By: Daily Wire

|

|

A black Georgia activist became the center of attention at a rally for former president Donald Trump on Saturday when she riled the crowd in support of Trump and how his policies benefit black Americans.

Published: Wednesday, August 14th, 2024 @ 2:17 am

By: Daily Wire

|

|

Former President has been indicted by a federal judge in Pennsylvania for inciting an assassination attempt that nearly killed him.

Published: Wednesday, August 14th, 2024 @ 1:36 am

By: Babylon Bee

|

|

A federal judge ruled on Monday that Google has a monopoly over general search engine services, siding with the Justice Department and more than two dozen states that sued the tech company, alleging antitrust violations.

Published: Wednesday, August 14th, 2024 @ 1:28 am

By: Daily Wire

|

|

girl has now de-transitioned and back to living as a girl

Published: Tuesday, August 13th, 2024 @ 9:11 pm

By: John Steed

|

|

3 debates and Twitter interview

Published: Tuesday, August 13th, 2024 @ 7:13 pm

By: John Steed

|

|

new conservative government is delivering

Published: Monday, August 12th, 2024 @ 8:38 pm

By: John Steed

|

|

this guy is dangerous to America

Published: Monday, August 12th, 2024 @ 5:39 pm

By: John Steed

|

|

Acting U.S. Secret Service Director Ronald Rowe told reporters on Friday that his agency was fully responsible for the assassination attempt on former President Donald Trump last month and that the agency “should have had eyes” on the roof where 20-year-old Thomas Matthew Crooks.

Published: Monday, August 12th, 2024 @ 5:35 pm

By: Daily Wire

|

|

US should not stand for this

Published: Monday, August 12th, 2024 @ 4:52 pm

By: John Steed

|

|

propaganda drives the politicized climate alarmism movement

Published: Sunday, August 11th, 2024 @ 10:54 am

By: John Steed

|

|

Ranks 32nd in Nation

Published: Saturday, August 10th, 2024 @ 11:21 am

By: Countrygirl1411

|

|

Smartmatic was at center of voting machine controversy in US 2020 election

Published: Friday, August 9th, 2024 @ 9:07 pm

By: John Steed

|